option to tax togc

As may be seen timing with a property TOGC is of utmost importance. Clark Hill Ltd 2018 UKFTT 111 TC.

Vat Update June 2022 Saffery Champness

Option to Tax is effective from the date decision to opt is made if HMRC is notified within 90 days.

. They may therefore ask the buyer for. The vendors solicitor is claiming. Based On Circumstances You May Already Qualify For Tax Relief.

Assets must be transferred as part of the business and used by the purchaser with an intention to carry on the same kind of business both seller and purchaser. An option to tax should normally be notified to HMRC within 30 days of the date of the decision to opt albeit as explained below this has now been temporarily extended to 90. The taxpayer provides evidence that output tax has been properly charged and accounted for since the date of the option and input tax claimed in accordance with the option and a responsible.

The area of VAT law which specifies the supplies of land and buildings that are exempt from VAT is Group 1 of Schedule 9 to the Value Added Tax Act 1994. For example an option to tax one day late will invalidate TOGC treatment. Note that the vendor is ultimately responsible for applying the correct VAT treatment.

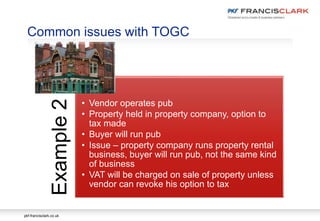

However they are not going to opt to tax. Sovos managed services makes sales tax filing easier for online sellers and merchants. Demonstrating that an option to tax has been made can be important.

Where the written notification of the option is sent to. The option to tax by the purchaser must be notified to HMRC in writing no later than the relevant date and must apply from that time. TOGC allows the sale to be treated as neither a supply of goods nor a supply of services.

A new owner needs to opt to tax in order to get the tax benefits rather than inherit the option to tax from the vendor. The option to tax rules as they apply to transfers of a going concern are set out in Article 52 of the VAT Special Provisions Order SI 19951268 as amended by SI2004779. To qualify the purchaser must by the relevant date have notified its own.

It was agreed between the parties that the relevant TOGC point in issue was whether the notification of the option to tax by the purchasers of the four properties was made. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. A property purchaser may require proof before paying VAT or a seller may require proof that the purchaser.

In special cases prior permission from HMRC is needed. Ad Browse Discover Thousands of Law Book Titles for Less. Ad Our tax preparers will ensure that your tax returns are complete accurate and on time.

A recent VAT case from the Chesterfield area highlights the importance of taking advice. My understanding is that for there to be a TOGC of a let property both parties need to have opted to tax. TOGC requires an option to tax before a deposit is paid.

If the transaction is to be treated as a TOGC the seller must be satisfied that the buyers option to tax is in place by the relevant date. Option to tax can be overridden or disapplied. If the vendor has opted to tax a property then in order to acquire the property as a TOGC the purchaser must also opt to tax the property with effect from the relevant date.

The case involved the transfer of a property business and so combined the complex. A guide to land and.

Togc Transfer Of A Going Concern Vatupdate

How To Buy Commercial Property Without Paying Vat Togc Youtube

How To Apply The Capital Goods Scheme

Transfers Of Going Concerns A Taxing Issue

Austria Vat Gst And Sales Tax Guide By Worldtradepresss Issuu

Fae Mock Examinations 2012 Advanced Taxation Elective

Option To Tax Process Effect On Sub Leases Cancellation Uk Property Accountants Property Tax Specialists

Vat When Buying Or Selling A Property Business What Is Togc

Vat Option To Tax On Properties

Vat On Commercial Property A Complete Guide

Property Sector Annual Update 2017

Extension Of Time Limit To Notify Options To Tax Crowe Uk

Zero Vat On Property Transfers Shipleys Llp

Application Of The Transfer Of A Going Concern Rules Taxation

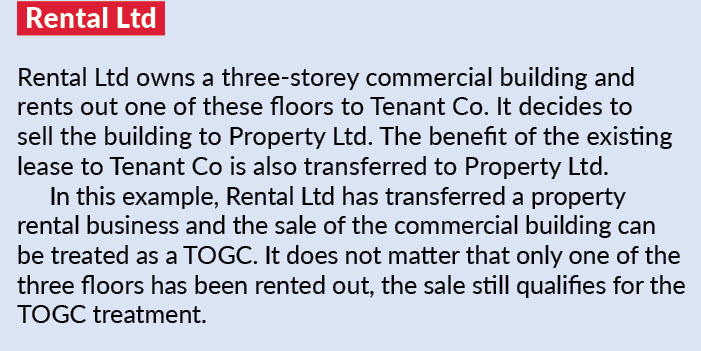

When Is The Sale Of Property A Transfer Of A Going Concern Togc For Vat Purposes

Commercial Properties As A Transfer Of A Going Concern Carpenter Box